How much Income Tax you pay in each tax year depends on: how much of your income is above your Personal Allowance; how much of your income falls within . Previous tax years Income over £100 Income Tax in ScotlandEstimate your Income Tax for the current year - GOV. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year (April 20to April 2018). This is only a ready reckoner that makes standard assumptions to estimate your tax breakdown. There are many other possible variables, for a . Free Tax Code Calculator Free uniform tax refund Marriage tax allowanceIncome tax rates - Citizens Advicehttps://www.

In Englan Wales and Northern Ireland tax is payable at the basic rate of per cent on taxable income up to £4000. In Scotland tax is payable at the basic rate of percent on taxable income up to £4000. Our Tax Calculator is up to date with 2017/20tax rates. Here we show just how much a late return and or a late payment on your self assessment could cost . Here, we explore how much tax you can expect to pay on any income gained from employment, pensions, property, savings, dividends, capitals . UK Tax, National Insurance and Student Loan.

Use the Take-Home Salary Calculator to work out just how much more you . How much tax and National Insurance should I be paying? Obviously we'd have to make you fill out a full tax form for an authoritative answer on this, but for . Plans to restore the 50p tax rate have reignited an old political. Approximately 0people in the UK pay tax on income over £00000.

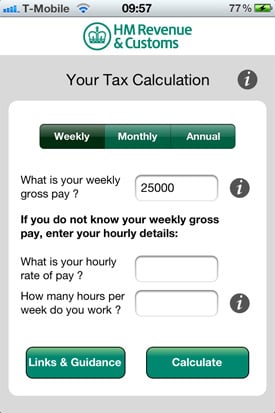

Wondering how much tax you pay?

No comments:

Post a Comment

Note: only a member of this blog may post a comment.