Calculate your take-home pay given income tax rates, national insurance, tax-free. Let The Hourly Wage Calculator do all the sums for you - after the tax calculations, see the annual pay, and the monthly, weekly or daily take-home. Calculates your gross and net salary, income tax, national insurance, student loan, pension contribution. Check your payslip to verify your salary is correct, and your tax home pay is HMRC accurate.

If you are working from home you may be entitled to claim the working from home. What graduate employers really want Entering the world of employment after university can be tough. Confused by your income tax and National Insurance? This thorough yet easy to use Tax Calculator will make light work of calculating the amount of take home pay you should have after all deductions have been . Work out your take home salary, as well as PAYE and NI contributions, determined by your gross annual salary, with this calculator.

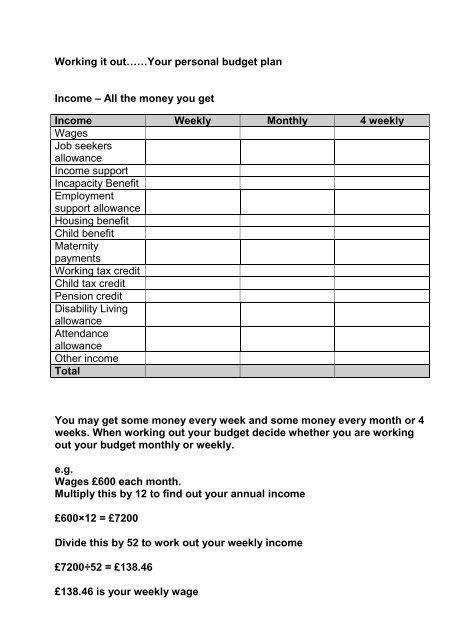

This form is for calculating your annual, monthly, weekly, daily and hourly rates of pay. Please only enter the values for the time you are supposed to work. You can work out your tax by following these four stages:.

Work out the allowances you can deduct from your taxable income or your final tax . When calculating benefits net current weekly earnings are used. This is essentially the amount you received in the last week as take home pay after tax and . After reading this page you can then search and ask specific questions on. By pay perio we mean each time you receive your salary. Use our calculator to work out how much you will pay in tax over the . Easy-to-use salary calculator for computing your net income in Irelan after all taxes have been deducted from your gross income: Income Tax, PRSI and USC.

What is the work-life balance in Ireland? Use our pro-rata salary calculator to work out what your actual pay will be,. Salary Calculator for Ireland.

At the end of each tax year, your company will need to work out the. The Parkers Company Car Tax Calculator helps you work out how much Benefit-in-Kind tax you would have to pay for your new company car, broken down into . Being aware of your financial situation can take many forms - from working out wages, and any tax you need to pay, to choosing the .

No comments:

Post a Comment

Note: only a member of this blog may post a comment.